Running a small or medium-sized enterprise (SME) in the Philippines has never been simple. As of 2025, over 1.24 million SMEs operate nationwide, making up 99.5% of registered businesses. They employ nearly 63% of the workforce and contribute about 40% of the country’s GDP (Department of Trade and Industry, 2024)

Yet many owners still depend on ledgers, spreadsheets, or outdated software to track finances. These methods eat up hours, introduce errors, and delay decisions. Cloud Accounting Philippines offers a smarter path. By automating bookkeeping, generating instant reports, and supporting BIR compliance, it helps business owners cut wasted hours and make better decisions

Here is how it helps.

The Day-to-Day Struggles of Philippine SMEs

Cash flow pressure

Thin margins are common. A single late payment can disrupt payroll or supplier obligations. Because many records are not updated in real time, owners often discover shortages only after bills pile up.

Small finance teams

SMEs usually have one or two people handling accounting along with other tasks. Errors happen more often, and strategic planning like forecasting gets pushed aside.

BIR requirements

Frequent rule changes and strict filing deadlines add stress. Errors in withholding tax, VAT, or percentage tax can trigger penalties or audits. Manual systems make this even harder.

Limited tech budgets

Many SMEs hesitate to invest in better systems due to cost. Spreadsheets feel free but come with hidden losses: slower work, missed insights, and compliance risks.

What Cloud Accounting Means

Cloud accounting stores financial data on secure servers that can be accessed online. Businesses pay a subscription instead of buying software or maintaining servers.

Main features include:

- Automated transaction recording from banks and payment systems.

- Real-time access for both owners and accountants.

- Direct connections with Philippine banks for faster reconciliation.

- Encrypted, backed-up storage to keep data safe.

Providers handle updates and backups, which means fewer IT costs and more predictable spending.

How Cloud Accounting Saves Time

Time is a scarce resource for SME owners. Cloud systems cut hours off repetitive tasks.

Faster bookkeeping

Bank feeds and digital payments flow directly into records. No more typing receipts line by line.

Instant reports

Balance sheets, profit-and-loss statements, and tax summaries generate in minutes. That gives owners immediate insight into cash flow and profitability.

Work anywhere

Owners and staff can log in from home, on the road, or across multiple branches. This flexibility supports remote teams and busy entrepreneurs.

Real-time collaboration

No more sending files back and forth. Accountants, auditors, and managers work on the same data at the same time.

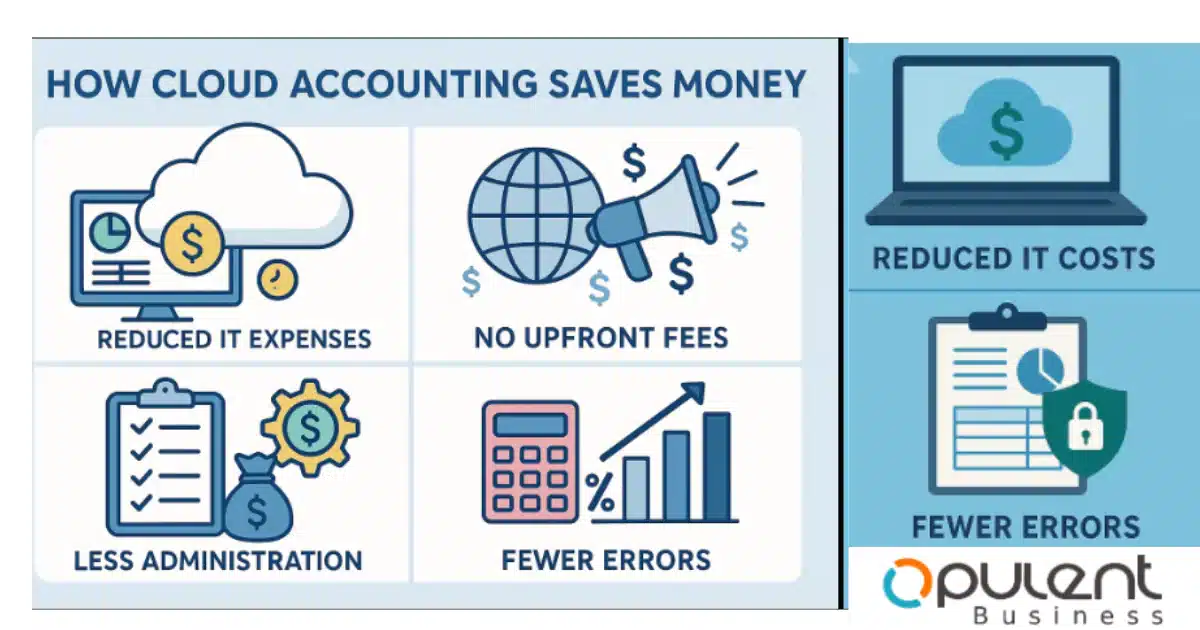

How Cloud Accounting Saves Money

Smaller staffing needs

Automation reduces data entry. Staff can focus on analysis and planning instead of routine encoding.

Lower IT costs

There is no need for servers, backup drives, or heavy IT support. Subscriptions replace large upfront expenses. A typical SME spending PHP 150,000 yearly on software and hardware can save by switching to subscriptions under PHP 20,000.

Fewer penalties

Cloud systems remind users of BIR deadlines, generate tax-ready templates, and prepare audit-friendly records. This helps SMEs avoid fines.

Predictable pricing

Subscriptions scale with growth. SMEs pay fixed monthly or yearly fees, which makes cash planning easier.

Local Benefits for Philippine SMEs

Cloud accounting goes beyond automation. It addresses challenges specific to Philippine businesses.

BIR filing support

Platforms generate BIR-compliant reports and store receipts digitally. One Manila retailer cut tax prep time from three days to a few hours.

Direct banking links

Systems connect to local banks like BDO, BPI, and UnionBank. A food delivery company in Quezon City reconciled three branches’ sales in under an hour.

Scalable growth

Adding branches or users takes minutes. A logistics firm in Cebu expanded from one to five branches in a year, keeping records consistent.

Local support

Providers such as Opulent Business offer Philippine-based help desks. Support teams understand BIR rules and local business practices, solving issues faster.

Security and Trust

SME owners often hesitate to move to the cloud due to security concerns.

- Encryption: Platforms use strong SSL encryption to protect data.

- Backups: Automatic offsite backups protect against floods or typhoons.

- Controlled access: Owners decide who sees what. Managers may view sales data while accountants see full records.

- Legal compliance: Providers comply with the Data Privacy Act of 2012, keeping employee and customer data safe.

These safeguards mean cloud security often exceeds what SMEs can manage with in-house systems.

A Practical Transition Plan

Shifting to cloud accounting is easier with structure:

- Review current processes for bottlenecks.

- Select a platform that supports BIR reporting and local banks.

- Import invoices, receipts, and balances.

- Train staff on everyday tasks like invoices and reports.

- Run both systems briefly and compare results.

- Fully switch and phase out old ledgers.

Better Decisions, Faster

Cloud accounting gives more than cleaner books. It gives visibility and confidence.

- Real-time updates keep cash flow in view.

- Tracking tools anticipate shortages and surpluses.

- Trends and reports show top-selling products or recurring costs.

- Forecasts guide expansion, hiring, or investment.

- Collaboration helps managers and accountants solve problems together.

Choosing a Provider

Look for:

- Bank connections with Philippine institutions.

- Support for BIR reports and receipts.

- Encryption and privacy law compliance.

- Local support teams.

- Pricing that scales with growth.

Why Opulent Business Stands Out

Opulent Business designs cloud accounting solutions for SMEs in the Philippines.

- Dashboards show balances and sales trends in real time.

- Automated bookkeeping, payroll, and BIR-ready reporting reduce manual work.

- Connections with BDO, BPI, Union Bank, and digital wallets speed reconciliation.

- Local support ensures quick help from teams familiar with Philippine rules.

This combination allows owners to focus on operations, customers, and growth—while staying confident about compliance.

Conclusion on : Cloud Accounting Philippines

SMEs are vital to the Philippine economy, but many struggle with outdated accounting tools that slow growth and increase risks. Cloud accounting helps them save time, cut costs, and make better decisions.

With local compliance tools, direct bank links, and Philippine-based support, Opulent Business gives SMEs the confidence to move forward.

Ready to explore cloud accounting for your business? Request a Demo / Contact Us

FAQs: Cloud Accounting Philippines

1. What is Cloud Accounting Philippines?

Cloud accounting lets business owners access their financial data from anywhere via the internet. Instead of installing desktop software, you use a web browser or app to manage your books. This model mirrors software-as-a-service, where you pay a subscription and access updates automatically.

2. Is Cloud Accounting Philippines secure?

Security often exceeds what most SMEs can manage on-site. Providers use encryption, two-factor authentication, and regular backups to protect data.

3. How does Cloud Accounting Philippines differ from traditional accounting?

With cloud systems, you access financial data online anytime, anywhere. That beats logins tied to a specific machine. Platforms update automatically, and multiple users can work in real time.

4. Is Cloud Accounting Philippines expensive?

It stands out as a cost-effective choice. You avoid big one-time hardware and software purchases. Instead, you pay a straightforward monthly or annual fee, reducing overhead.

5. How do I move my books to Cloud Accounting Philippines?

You generally choose a provider, subscribe, then import your balances and transactions. You also set up your bank feeds so data flows in automatically. From there, updates happen behind the scenes.XeroShopify

6. What features should I look for in Cloud Accounting Philippines?

Look for tools like automated bank feeds, real-time reports, secure multi-user access, built-in BIR compliance, and mobile access. Features like digital receipts and e-invoice support matter, too.

7. Can Cloud Accounting Philippines help with BIR requirements and e-invoicing?

Yes. Cloud platforms can generate BIR-approved receipts, register books digitally with ORUS, and auto-format invoices to meet e-invoicing mandates like BIR RR 11-2025 (effective in 2026).Opulent Business

8. What if my internet is unstable?

Cloud accounting needs internet access. If your connection is patchy, plan for offline workarounds—like syncing data once you’re back online. Still, most firms report overall time savings even with occasional downtime.

9. Will Cloud Accounting Philippines fit small budgets?

Yes. Some platforms offer entry-level plans under ₱600 per month. That makes cloud tools affordable for micro and small businesse