As your business grows, so does the need for smarter tools. That’s when terms like ERP and POS begin popping up. You’ve probably heard people talk about them together. But do you really need both? Or even one of them? If you’re feeling unsure, you’re not alone. In this blog, we’ll break down what ERP and POS systems really are, how they differ, and which one (or both) might be right for your business.

ERP vs POS: Clearing the Confusion

At first glance, ERP and POS systems might seem similar; after all, they both deal with business operations. But they serve very different purposes.

Think of a POS system as your front-line assistant. It helps you handle sales, process payments, manage inventory in real-time, and serve customers directly at the counter or online.

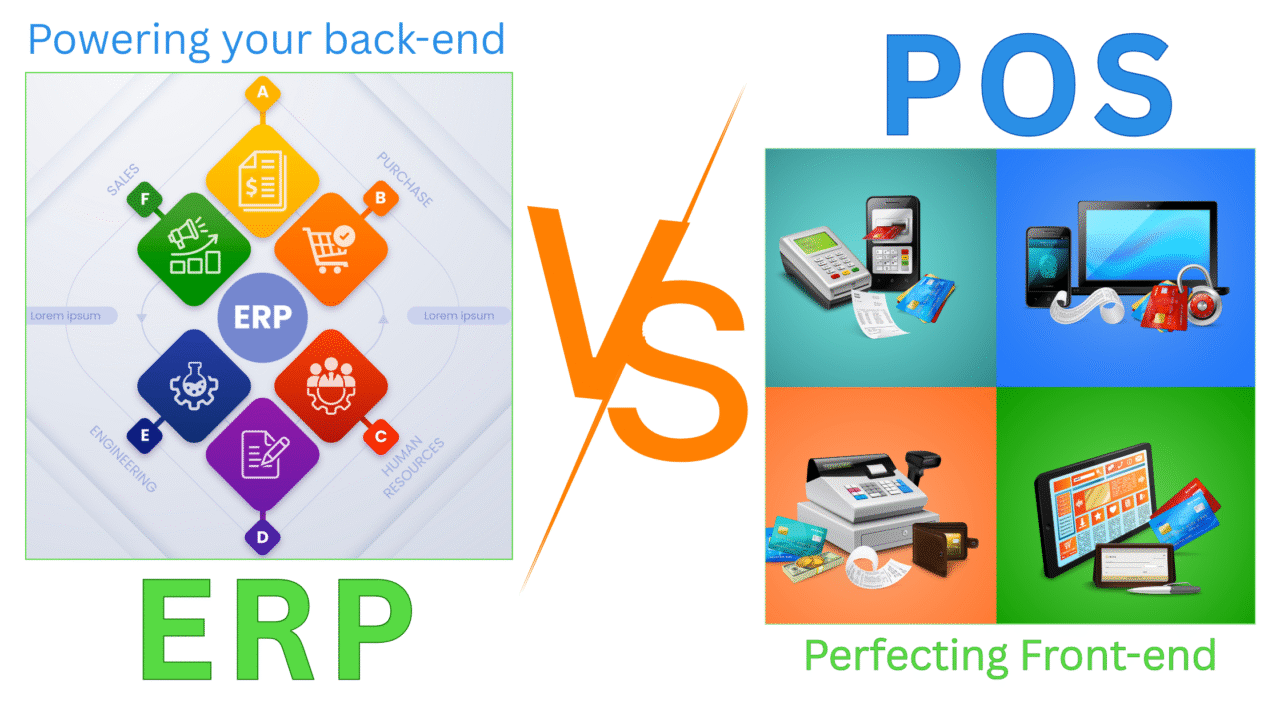

Now, what’s an ERP system? It’s more like the brains of your entire operation. It connects and manages everything from sales and inventory to finance, HR, supply chain, and more, all in one integrated platform.

ERP focuses on managing and integrating all core business processes across the entire organization, from finance and human resources to inventory and supply chain, whereas POS is primarily concerned with managing and executing sales transactions and immediate customer interactions at the point of sale.

Consequently, ERP’s scope encompasses the entire business, addressing back-office to front-end operations, while POS is primarily customer-facing.

The key functions of ERP include financial accounting, comprehensive inventory management, procurement, human resources, and often customer relationship management, alongside extensive reporting capabilities, in contrast to POS, which focuses on sales processing, handling payments, generating receipts, basic inventory tracking directly at the transaction point, and capturing essential customer data.

The typical users of ERP systems are accountants, operations managers, HR personnel, and executives who rely on its comprehensive business-wide data and analysis, while POS systems are mainly used by sales staff and cashiers who handle transactional data and immediate sales information.

Essentially, POS is your digital cash register and sales hub, focused on the moment of transaction. ERP is the central nervous system of your entire business, orchestrating all the moving parts behind the scenes.

ERP vs POS is the common comparison because they both represent critical software investments for businesses, particularly those in retail, hospitality, and, increasingly, service industries that involve direct customer transactions and inventory management.

While ERP offers a broad, integrated view of the entire business, and POS focuses on the transactional point, the overlap in areas like inventory management, sales data collection, and customer relationship management creates a natural point of comparison.

Businesses often evaluate whether their needs are sufficiently met by one system or if the benefits of integrating both outweigh the costs and complexity. The desire for a unified view of sales impacting overall business operations, from stock levels to financial reporting, drives this comparison as businesses seek the most efficient and insightful solution for their specific needs.

When a Business Might Need Only One System

Believe it or not, some businesses can thrive, at least initially, with just one of these systems:

- POS Only (for Very Small Retail/Service Businesses): A small boutique, a coffee shop, or a single-location service provider with straightforward operations might initially only need a robust POS system. Their primary focus is efficient sales processing, managing daily transactions, and perhaps basic inventory tracking directly at the point of sale. For instance:

- A local bakery focuses on selling directly to customers. A good POS handles orders and payments and might track ingredient stock levels. Their overall financial management might be simple enough to handle with basic accounting software or manual methods at this stage.

- A small hair salon primarily needs a system to schedule appointments, process payments, and manage client information. A sophisticated POS with CRM features might suffice.

- ERP Only (for B2B or Large Enterprises with Complex Operations but Indirect Sales): Businesses that don’t have direct, high-volume point-of-sale transactions might primarily rely on an ERP system. Think of:

- A manufacturing company selling large orders directly to other businesses. Their focus is on managing production, supply chains, and complex invoicing, with sales happening through contracts and purchase orders rather than a traditional checkout.

- A software-as-a-service (SaaS) company. Their “sales” involve subscriptions and renewals managed within a CRM module often integrated into their ERP, without physical point-of-sale interactions.

In these scenarios, the core needs of the business are heavily bent towards one type of system, making the other less immediately critical.

ERP vs POS: Why Growing Businesses Shouldn’t Have to Choose

As your business expands and becomes more complex, relying on a single system often leads to inefficiencies, data silos, and missed opportunities. This is where the magic of combining ERP and POS truly shines:

- Seamless Data Flow: Integration between your POS and ERP eliminates the need for manual data entry between sales and back-office functions. Sales data from your POS automatically updates inventory levels in your ERP, ensuring accurate stock counts and preventing stockouts or overstocking. Similarly, financial information from POS transactions flows directly into your accounting modules within the ERP.

- Enhanced Accuracy: By automating data transfer, you significantly reduce the risk of human error associated with manual data entry. This leads to more accurate financial records, inventory counts, and sales reporting.

- Smarter Decision-Making: With integrated data, you gain a holistic view of your business performance. You can analyze sales trends from your POS alongside inventory levels and financial data in your ERP to make informed decisions about purchasing, pricing, and promotions. For example, identifying best-selling items through POS data and ensuring sufficient stock levels via the ERP.

- Improved Customer Experience: Integration can lead to a better understanding of your customers. Data captured at the POS (purchase history, preferences) can be fed into the ERP’s CRM module, allowing for personalized marketing efforts and improved customer service.

- Scalability for Growth: As your business grows, the volume of transactions and the complexity of your operations increase. Integrated ERP and POS systems provide a scalable infrastructure that can handle this growth without requiring you to overhaul your entire system.

- Operational Efficiency: Automating processes between sales and back-office functions frees up your team to focus on more strategic tasks, improving overall operational efficiency and reducing administrative overhead.

In Conclusion:

While very small or highly specialized businesses might initially function with just a POS or an ERP system, for most growing businesses, ERP vs POS shouldn’t be the question; the power that comes from bringing both ERP and POS together is priceless. Combining the customer-facing power of a POS with the comprehensive management capabilities of an ERP unlocks a level of efficiency, accuracy, and insight that propels sustainable growth and smarter decision-making.

If you’re planning to scale, integrating ERP and POS could be the smartest move you make.

Still unsure about ERP vs POS or how to integrate both? We’re here to help. Let’s talk.