Understanding the Importance of Cloud-Based Accounting Softwares for MSMEs

Let’s first understand what cloud-based accounting is.

To put it simply, cloud-based accounting software enables users to access their financial information from the Internet, as it is stored in remote servers. This means no more installing software on standalone computers, keeping data backups on external drives, and less worrying about physically being at the workplace.

Accounting in the cloud is rapidly transforming the financial management practices of Micro, Medium and Small Enterprises and Accelerated Digital Adoption in 2025 makes it more important than ever to understand how cloud accounting works and why it matters for the businesses trying to optimize processes, cost reductions, and maintain a competitiveness.

How does it work?

1. Anytime anywhere access.

Cloud-based accounting allows businesses to remotely access their financial information and tools whenever they have an internet connection. This makes it easier for employees and business owners to collaborate, update the accounting books, and make decisions outside the office, which is beneficial for small and medium-sized enterprises with remote employees.

2. Solutions that are affordable and easy to scale.

Some traditional accounting software may require a large upfront investment for equipment, licenses, and IT support. Cloud accounting, however, works on a subscription basis, making it affordable for businesses. There are no expensive infrastructure requirements, and organizations are able to quickly scale their consumption as they grow, effortlessly adding services or users when needed.

3. Enhanced data security and reliability.

Data breaches are one of the most important risks for businesses. Cloud accounting services protect sensitive financial data with rigorous measures like data encryption, frequent backups, and strict authentication protocols. This level of protection is beyond what small organizations can achieve on their own, reducing the risk of data loss or exposure significantly.

4. Financial analytics.

Businesses are able to monitor their economic well-being using cloud accounting with extreme precision. Updates happen automatically, meaning that the data on inventory, sales, and cash flow is up to date at all times, enabling timely decision-making for the business. Managers are able to monitor precise trends and key metrics with the help of reporting and dashboards.

5. Time Saving Precision.

Routine tasks such as invoice generation, sending payment reminders, and bank reconciliation, among others, are done automatically in the cloud. With business owners and personnel spending very little time on manual tasks, focus can shift toward business-critical functions and strategies.

6. Enhanced Cooperation And Help.

Accounting collaboration using cloud accounting is simple and seamless as accountants, bookkeepers, and even the team members can collaborate. Sensitive information is protected by Role-based access controls, allowing only selected individuals to authorized data. On-demand technical support offered by many suppliers reduces the need for in-house IT expertise, streamlining productivity.

7. Going Paperless and Staying Organized

The digitization of receipts, invoices, and various business documents enhances the operations of businesses, as it reduces the chances of losing papers and increases organizational efficiency. With structured and searchable information, cloud accounting enhances the ease of auditing and compliance.

8. Competitive Advantage and Growth.

Businesses that use cloud accounting are able to make sense of data and make rapid, accurate decisions, allowing them to change with the market and stay ahead of the competition. Research indicates that businesses that adopt cloud solutions experience accelerated growth and are more readily able to innovate and adapt to client requirements

Such accounting services enhance the flexibility, cost efficiency, security, and real-time visibility of an organization’s data for businesses, which are critical for success in a dynamic business environment. In 2025, as more businesses are opting for digital solutions, cloud accounting will serve as a smart investment for sustainable growth and improved business management.

Key Features to Look for in an Accounting Software

Each accounting software should be able to handle the basic accounting tasks of recording transactions, tracking payments and generating financial statements.Some businesses might need additional features like advanced analytics, mobile support, payroll management, asset tracking, budgeting,project accounting etc. So, It’s important to look at each feature closely when choosing an accounting software to ensure that it meets your needs in present and in the future.

Here are the Key features to consider when choosing any cloud based accounting software for your business

1. Core Accounting

This is the backbone of any accounting system, handling transactions, ledgers, and journals. It ensures financial records are accurate and compliant — essential for audits, reporting, and decision-making.

2. Inventory Management

Having this feature allows businesses to maintain clear records of stock, purchases, and usage. Linking this with accounts helps reduce waste, prevent stock-outs, and tie inventory costs directly to financials.

3. Budgeting and Forecasting

When businesses plan expenses and predict revenues,this feature offers a clear picture of future cash flow. This is crucial for managing resources wisely and preparing for growth or slowdowns.

4. Tax Management

This helps in reducing manual calculation errors and helps with compliance.Accounting software with built-in tax management tools simplifies returns filing and keeps businesses safe from penalties or late fees.

5. Fixed Asset Management

Tracking the value and other details of fixed assets over their entire useful lifespan, can be complicated. That’s why many companies use fixed asset management, to track the company’s total asset bases. Fixed asset management software automates depreciation calculations, typically with the ability to use different depreciation methods and for tax purposes as necessary. This helps maintain accurate financials and plan for maintenance, upgrades, or asset sales.

6. Multi-Currency Support

For businesses involved in international trade this feature allows seamless cross-border transactions without manual conversions, helping maintain correct records,generate reports in different currencies and reduce Forex losses.

7. Automated Data Backup

Data loss can disrupt business. Cloud accounting software with automatic backups ensures that your financial records are safe, up to date, and recoverable anytime.

8. Integration & Scalability

Accounting doesn’t work in isolation. Integration with systems like POS, payroll, or inventory allows real-time syncing. Integration facilitates data sharing across the organization and gives every department a more complete view of the business in real time.while scalability ensures the software grows with your business.

9. Payroll Processing

As businesses expand, manual calculation and management of payroll becomes increasingly complex.It helps to manage employee salaries, deductions, and compliance automatically. It reduces manual errors and saves time, especially useful for MSMEs without a full HR department.

10. Reporting & Analytics

Leading accounting software offers customizable dashboards with real-time, role-based access that help financial teams monitor key metrics and identify trends. Advanced analytics tools provide a clear picture of the company’s financial health, turning complex data into actionable insights. Businesses can track profits, expenses, and trends efficiently, enabling better decisions—without needing deep financial expertise.

11. Bank Reconciliation

This feature matches accounting records with bank statements to identify discrepancies.It improves accuracy, prevents fraud, and builds trust in your financial data.

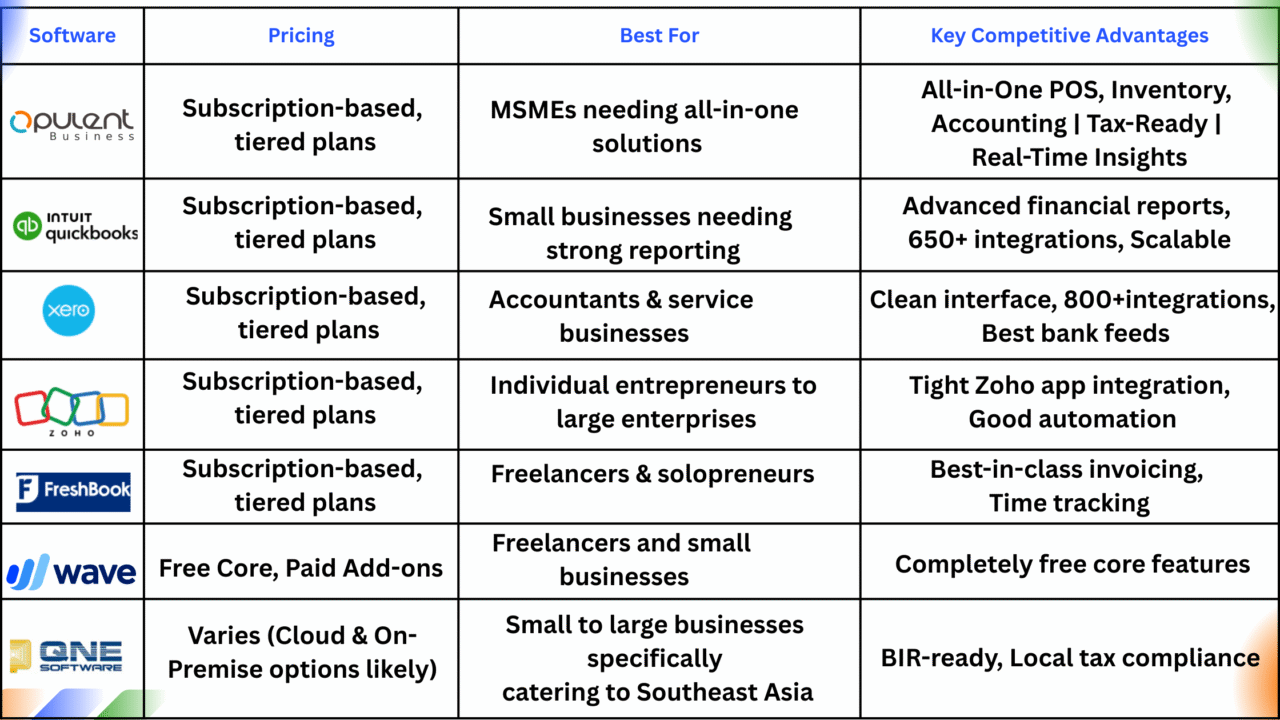

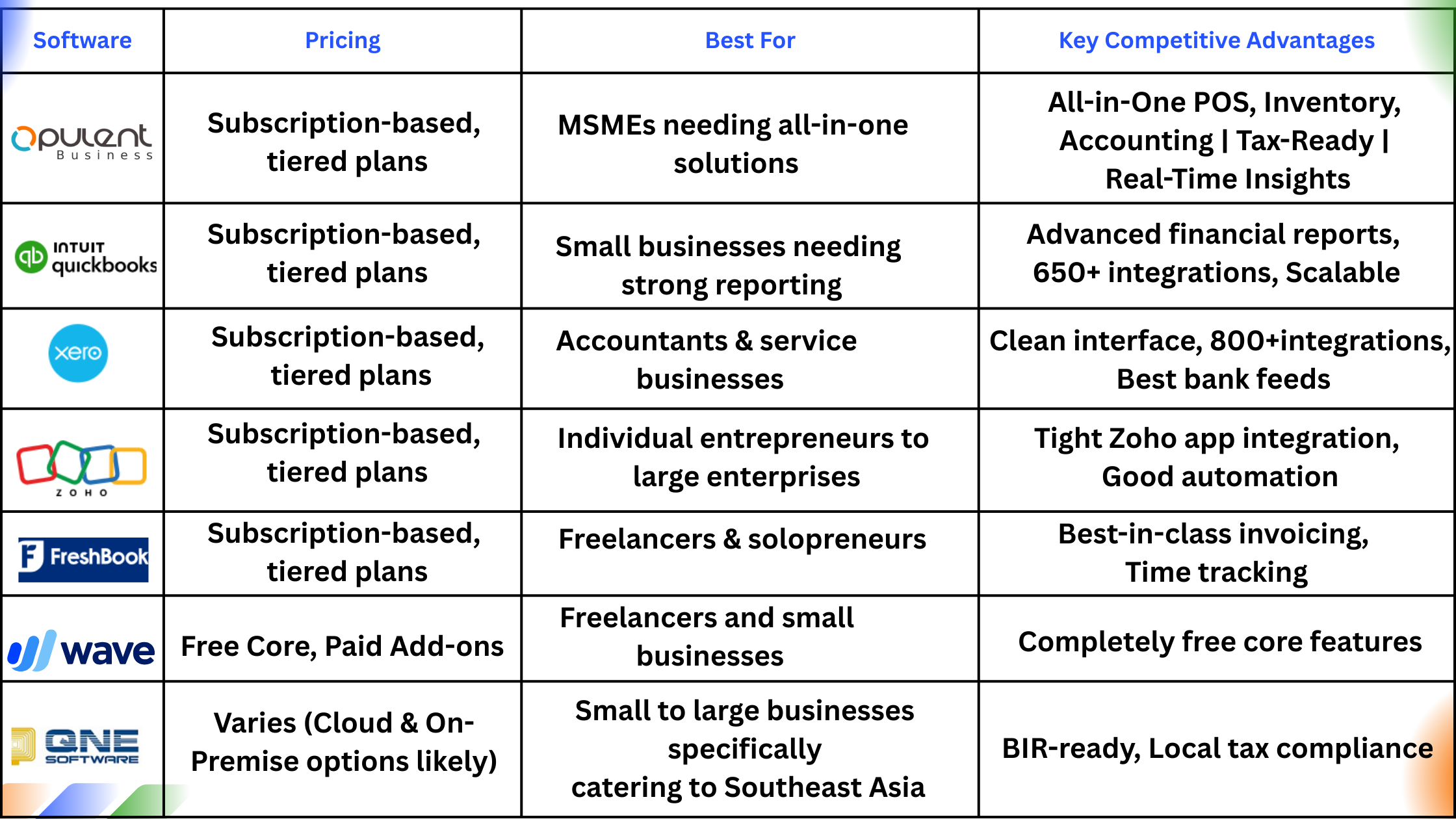

Top Cloud-Based Accounting Softwares for MSMEs

QuickBooks is a popular software developed by Intuit, particularly for small and medium-sized enterprises. It provides a number of capabilities for managing different financial activities, such as monitoring revenue and spending, invoicing, bill administration, payroll (in some versions or with add-ons), inventory management (in some plans), and creating financial reports. It is available in both desktop and cloud-based (QuickBooks Online) versions and seeks to simplify accounting by giving businesses tools to manage their money, automate tasks, and obtain insights into their financial performance, often connecting with other business software.

Zoho is a vast and versatile software firm that provides a complete suite of cloud-based apps to assist organizations in managing many parts of their operations. CRM and sales solutions are among its services, which also include marketing automation, customer support, finance and accounting (Zoho Books), HR management, project management, and collaboration platforms. Zoho’s has a tightly connected ecosystem, which allows diverse apps to operate together effortlessly, giving organizations a unified platform to improve workflows, increase productivity, and obtain superior insights into their data.

Xero is a cloud-based software platform intended mostly for small and medium-sized enterprises. Based in New Zealand, Xero provides a full suite of online tools that allow businesses to manage their finances from anywhere with an internet connection. Bank reconciliation with automated bank feeds, online invoicing, bill payment, expenditure management, inventory tracking, payroll (in some countries or with add-ons), project tracking, and comprehensive financial reporting with customized dashboards are some of the key features. Xero stresses usability and cooperation, allowing business owners and their advisers (accountants, bookkeepers) to collaborate on the same real-time data. Its vast app marketplace enables integration with a wide range of third-party business apps, expanding its capability to meet a variety of industry-specific requirements.

FreshBooks is a cloud-based software tailored to freelancers, solopreneurs, and small service-based organizations. It simplifies invoicing, expenditure monitoring, time tracking, and project management using a user-friendly interface that does not need accounting knowledge. FreshBooks excels in creating professional-looking invoices with configurable templates, automating recurring bills and payment reminders, and providing a variety of online payment alternatives to enable speedier payments. While it offers basic accounting features and reporting, it also serves the needs of project-based businesses and those primarily concerned with billing and managing clients, as well as integrating with other platforms for more advanced functionalities such as in-depth inventory management or complex payroll.

OpulentBiz is a cloud-based business management software built specifically for MSMEs, offering an all-in-one platform to streamline essential operations. It simplifies complex tasks across inventory and sales with features like multi-currency support, insightful financial reports, multi-warehouse inventory tracking, and a user-friendly POS system that supports smooth transactions and localized tax handling. Everything is accessible through an intuitive interface, with a centralized dashboard that gives you real-time visibility into your entire business. From managing finances and tracking stock to facilitating day-to-day sales, Opulent Business delivers a practical, integrated solution that eliminates the need for multiple disconnected tools. Opulent Business emphasizes affordability and accessibility, positioning itself as a cost-effective solution to aid organizations in their business transformation.

Wave is a cloud-based financial software specifically designed for small businesses, freelancers, and solopreneurs, particularly those with 1-9 employees. Originating from Canada, Wave offers a suite of free core accounting tools, including unlimited income and expense tracking, the ability to add unlimited users, double-entry accounting, and the generation of essential financial reports like profit and loss statements and balance sheets. Its user-friendly interface enables the quick production of invoices with adjustable templates, automated recurring billing, and online payment acceptance via interfaces with platforms like PayPal and Stripe.

Wave also makes it easier to track expenses by connecting customers’ bank accounts and credit cards for automated transaction imports, as well as providing a mobile app for receipt scanning and invoice management on the move.While Wave’s main accounting and invoicing functions are free, it generates revenue through paid add-on services, including payment processing, payroll (offered in select locations such as the United States and Canada), and premium support options..

QNE is a software solution, particularly popular in Malaysia and with a strong presence in the Philippines. It offers a range of features for businesses, including general ledger, accounts receivable, accounts payable, inventory management, invoicing, and potentially point-of-sale (POS) integration. QNE emphasizes user-friendliness and aims to cater to the specific needs and regulatory requirements of businesses in Southeast Asia, including features for tax compliance relevant to the Philippines (like BIR readiness) and potentially Malaysia. They offer cloud-based and on-premise options, along with features like real-time processing, multi-currency support, and customizable reporting, positioning themselves as a solution to streamline financial management and improve business efficiency for SMEs.

How Cloud Solutions Enhance Billing and POS Integration

Ultimately, the power of cloud-based solutions lies in their ability to connect crucial aspects of your business, and billing alongside your Point of Sale system is a prime example. Imagine a world where every sale instantly updates your inventory and triggers the appropriate invoice, eliminating manual data entry and reducing errors. This integration, facilitated by the cloud, provides a real-time overview of your sales cycle, from the moment a customer makes a purchase to the final payment.

Cloud-based software seamlessly connects billing and Point of Sale systems, helping businesses improve accuracy and reduce manual work. Real-time data sync ensures that every sale is instantly reflected in your accounting and inventory, removing the need for manual reconciliation. Whether it’s generating invoices, applying discounts, or managing customer records, cloud integration allows for smoother transactions and faster processing—boosting both operational efficiency and customer satisfaction.

The Future of Inventory Management in the Cloud

Looking ahead, the role of cloud technology in management for businesses is only set to become more critical. We’re moving towards a future where AI-powered insights predict demand fluctuations, automated systems trigger restocking orders, and real-time tracking provides unprecedented visibility across your entire supply chain – all accessible from anywhere. The cloud forms the backbone of this evolution, offering the scalability and connectivity required to implement these advanced features without significant infrastructure investment. By adopting cloud-based inventory management now, businesses are not just solving today’s challenges but also positioning themselves to utilize the intelligent, efficient, and agile solutions of tomorrow, ensuring they remain competitive and responsive in an ever-changing marketplace.